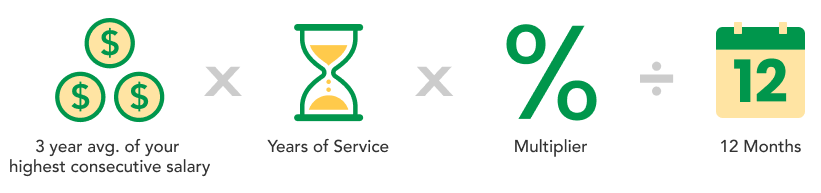

The amount credited monthly into your DROP account will be the Legacy benefit formula calculation as of the date you enter DROP.

Your ERFC pension benefit will receive annual retiree cost-of-living adjustment increases and your DROP account will earn an annual 4% interest rate compounded monthly unless the Board of Trustees adopts a lower rate for a particular fiscal year. Interest on your DROP account will only be applied for full months, not partial months.

When you exit DROP after 5 years (or sooner if you choose), you’ll receive the amount in your DROP account and your monthly ERFC pension will start being direct deposited into your bank account.

Please Note: Your retirement benefit will not be re-calculated when you leave DROP.